Moving average

Overview

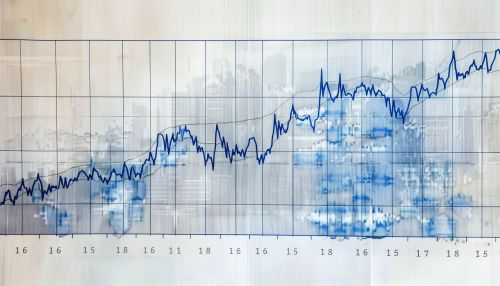

A moving average (MA) is a widely used statistical analysis tool that helps smooth out data by creating a constantly updated average price. It is commonly used with time series data to smooth out short-term fluctuations and highlight longer-term trends or cycles. The threshold between short-term and long-term depends on the application, and the nature of the data.

Types of Moving Averages

There are several types of moving averages that vary in their calculation methods. The most commonly used ones include the simple moving average (SMA), the exponential moving average (EMA), and the weighted moving average (WMA).

Simple Moving Average (SMA)

A simple moving average (SMA) is the simplest type of moving average. It calculates the average of a selected range of prices, usually closing prices, by the number of periods in that range. For example, a 10-day SMA is calculated by adding the closing prices of the last 10 days and dividing by 10.

Exponential Moving Average (EMA)

The exponential moving average (EMA) is a type of moving average that gives more weight to recent prices in an attempt to make it more responsive to new information. Unlike the SMA, the EMA's calculation is more complex as it involves more than just the simple average of the dataset.

Weighted Moving Average (WMA)

The weighted moving average (WMA) assigns a weight to all the data points based on their age. The WMA is calculated by multiplying each data point by a weight, summing these products, and then dividing by the sum of the weights.

Calculation

The calculation of a moving average involves a series of mathematical operations. The specific operations depend on the type of moving average being calculated.

Simple Moving Average Calculation

The calculation of a simple moving average is straightforward. It involves adding together a certain number of the most recent data points and then dividing by the count of those data points.

Exponential Moving Average Calculation

The calculation of an exponential moving average is more complex. It involves a weighting multiplier that is applied to the most recent data point in the data set. The formula for calculating the EMA involves using the price, the previous period's EMA, and a constant smoothing factor.

Weighted Moving Average Calculation

The calculation of a weighted moving average involves assigning weights to each data point, which decrease linearly. This means that the most recent data point has the highest weight, and the weight of each data point decreases for each previous point.

Applications

Moving averages have a wide range of applications in various fields, including finance, economics, and engineering.

In Finance

In finance, moving averages are commonly used as a technical indicator in trading. They are used to identify trends in the price of a security, with the assumption that these trends will continue. Traders use moving averages to help them decide when to buy or sell a security.

In Economics

In economics, moving averages are used to smooth out data series and identify trends. For example, they are often used in time series analysis to smooth out short-term fluctuations and highlight longer-term trends or cycles.

In Engineering

In engineering, moving averages are used in signal processing to smooth out signals and remove noise. They are also used in control systems to predict future values of a variable.

Advantages and Disadvantages

Like any statistical tool, moving averages have their advantages and disadvantages.

Advantages

Moving averages are simple to understand and use. They are a versatile tool that can be used in a variety of fields, from finance to engineering. They are also a useful tool for identifying trends in data.

Disadvantages

However, moving averages are not without their disadvantages. They are lagging indicators, meaning they only reflect past prices and are not predictive of future prices. They are also less effective in markets that are not trending.