Intellectual Capital

Definition

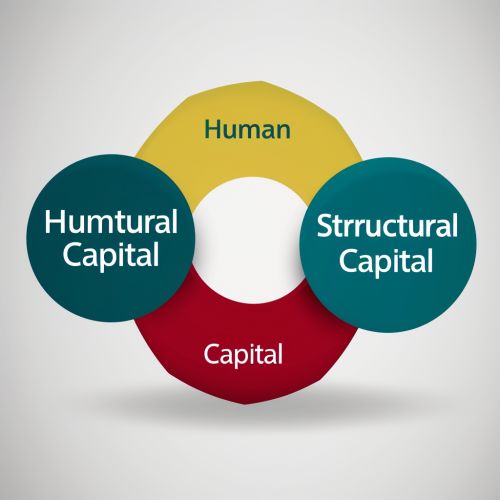

Intellectual capital refers to the intangible value of a business, including the knowledge, information, intellectual property, and experience that can be used to create wealth. It is the sum of everything everybody in a company knows that gives it a competitive edge. The term is used in academia and in business practice to outline three major components: human, structural and relational capital.

Components of Intellectual Capital

Intellectual capital is typically broken down into three components: human capital, structural capital, and relational capital.

Human Capital

Human capital is the collective knowledge, skills, abilities, and experience of an organization's employees. It includes the talent, creativity, and learning capacity embedded in the organization's individuals. Human capital is considered an asset, as it improves the company's performance and can be enhanced through appropriate human resource practices.

Structural Capital

Structural capital includes supportive infrastructure, processes, databases, patents, trademarks, and systems that enable the company to function. It is the supportive non-physical infrastructure that enables human capital to function. Structural capital is owned by the organization and remains with the organization even when individuals leave.

Relational Capital

Relational capital refers to the relationships and networks that an organization has with its customers, suppliers, and partners. It also includes sources of information, such as customer databases, and channels of information, like distribution channels. Relational capital can be a significant source of competitive advantage, as it can provide access to market, customer, and industry knowledge.

Measurement of Intellectual Capital

Measuring intellectual capital is a complex task due to its intangible nature. However, several models and frameworks have been developed to assist in this task. These include the Balanced Scorecard, the Skandia Navigator, the Intangible Asset Monitor, and the Value Added Intellectual Coefficient (VAIC).

Balanced Scorecard

The Balanced Scorecard is a strategic planning and management system used to align business activities with the vision and strategy of the organization. It provides a framework for measuring intellectual capital by focusing on four perspectives: financial, customer, internal process, and learning and growth.

The Skandia Navigator is a model developed by Leif Edvinsson of Skandia Insurance Company for measuring intellectual capital. It includes five focus areas: financial, customer, process, renewal and development, and human.

Intangible Asset Monitor

The Intangible Asset Monitor is a method developed by Karl-Erik Sveiby for measuring intangible assets. It divides intangibles into three categories: external structure, internal structure, and individual competence.

Value Added Intellectual Coefficient (VAIC)

The Value Added Intellectual Coefficient (VAIC) is a method developed by Ante Pulic. It measures the efficiency of value added by a company's physical and intellectual capital.

Importance of Intellectual Capital

Intellectual capital is increasingly recognized as a crucial asset and a key competitive differentiator in today's knowledge-based economy. It can contribute to a company's sustainable competitive advantage by enhancing its capacity to adapt and innovate.

Challenges in Managing Intellectual Capital

Despite its importance, managing intellectual capital presents several challenges. These include the difficulty of measurement, the risk of knowledge loss, and the need for a supportive organizational culture.