Bretton Woods System

Introduction

The Bretton Woods System was an international monetary system established in the mid-20th century. It was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The system was designed to prevent national trade barriers, to avoid depressions, and to encourage economic growth.

History

The Bretton Woods System was established in 1944 at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire, where 730 delegates from all 44 Allied nations gathered, making it the largest international economic conference in history. The delegates deliberated upon and signed the Bretton Woods Agreements during the first three weeks of July 1944.

Structure and Operation

The Bretton Woods System was based on a system of rules, institutions, and procedures to regulate the international monetary system. These rules were enforced by the IMF and the International Bank for Reconstruction and Development (IBRD), which later became part of the World Bank Group. The chief features of the Bretton Woods System were an obligation for each country to adopt a monetary policy that maintained the exchange rate of its currency within a fixed value—plus or minus one percent—in terms of gold and the ability of the IMF to bridge temporary imbalances of payments.

Impact and Legacy

The Bretton Woods System had a significant impact on global economics post-World War II. It established the U.S. dollar as the global reserve currency, replacing the British pound sterling. It also led to the establishment of several key international institutions and agreements, including the IMF, the World Bank, and the General Agreement on Tariffs and Trade (GATT), which later became the WTO.

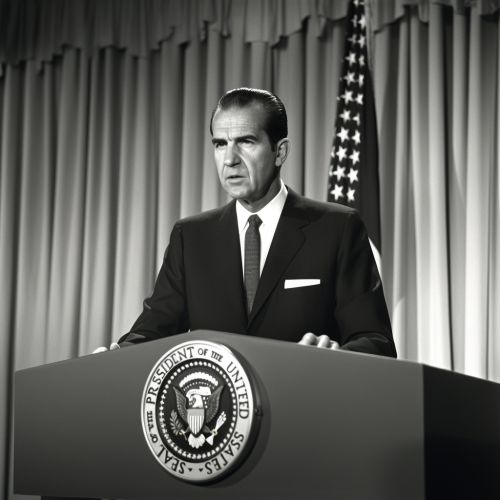

Collapse and Aftermath

The Bretton Woods System collapsed in 1971 when the United States unilaterally terminated convertibility of the U.S. dollar to gold. This action, known as the Nixon Shock, effectively ended the Bretton Woods System. Since then, the world has used a system of floating exchange rates.

Criticisms and Controversies

The Bretton Woods System has been criticized for its perceived bias towards the Western and developed nations. Critics argue that the system tends to favor the powerful economies while disadvantaging the developing economies. The system has also been criticized for its role in promoting globalization, which some believe leads to social inequality and environmental degradation.