Banking

History of Banking

The concept of banking has been in existence since the early civilizations, where temples were used as places of deposit for grains and other commodities. The modern banking system, however, traces its roots to medieval and early Renaissance Italy, in the rich cities in the north like Florence, Venice, and Genoa. The Bardi and Peruzzi families dominated banking in 14th-century Florence, establishing branches in many other parts of Europe. The most famous Italian bank was the Medici bank, established by Giovanni Medici in 1397.

Types of Banks

There are several types of banks including commercial banks, investment banks, savings banks, and credit unions. Each type of bank serves a specific purpose and offers different services to its customers.

Commercial Banks

Commercial banks are the most common type of banks. They provide a wide range of services to their customers, including accepting deposits, providing loans, and offering basic investment products.

Investment Banks

Investment banks assist individuals, corporations, and governments in raising financial capital by underwriting or acting as the client's agent in the issuance of securities.

Savings Banks

Savings banks were established to provide a safe place for individuals to save their money and to invest in a diversified portfolio of loans and securities.

Credit Unions

Credit unions are member-owned financial cooperatives that aim to provide credit at competitive rates and other financial services to their members.

Banking Services

Banks offer a variety of services to their customers. These include checking accounts, savings accounts, loans, and credit cards.

Checking Accounts

Checking accounts are a type of bank account where customers deposit money and can withdraw it by writing checks.

Savings Accounts

Savings accounts are accounts maintained by retail financial institutions that pay interest but cannot be used directly as money.

Loans

Banks provide loans to individuals and businesses for a variety of reasons. These can include personal loans, mortgages, and business loans.

Credit Cards

Credit cards are issued by banks to allow cardholders to pay a merchant for goods and services based on the cardholder's promise to the card issuer to pay them for the amounts plus the other agreed charges.

Regulation of Banking

Banks are heavily regulated by both national and international bodies to ensure their stability and integrity. In the United States, banks are regulated by the Federal Reserve, the Office of the Comptroller of the Currency, and the Consumer Financial Protection Bureau.

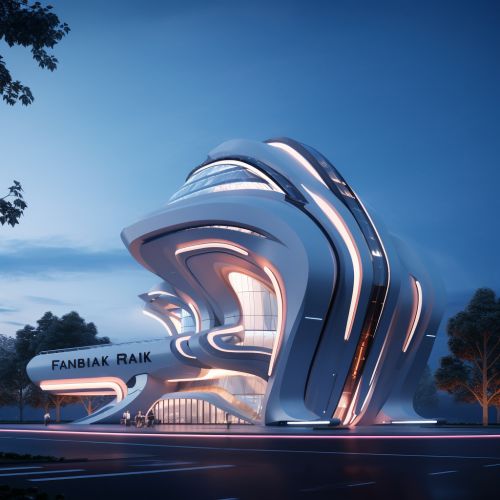

Future of Banking

The future of banking is likely to be shaped by technological advancements. The rise of fintech companies and the adoption of blockchain technology are expected to significantly impact the banking industry.